Lake Yindarlgooda

Lake Yindarlgooda (EL 28/2259) is an advanced asset with an Inferred Joint Ore Reserves Committee (“JORC”) Mineral Resource Estimate for Nickel and Copper announced at the project.

Modern Metals Corp Ltd holds the Lake Yindarlgooda tenement in joint venture with Australian public company Trans Pacific Energy Group Ltd, now 100% owned by UK company New Generation Minerals Limited (“NGM”) (“the Joint Venture”).

NGM currently holds 80% of the Lake Yindarlgooda project interest with Modern Metals Corp Ltd holding a free carried 20% during the exploration phase, allowing for a much accelerated exploration program.

JORC Resource Calculation

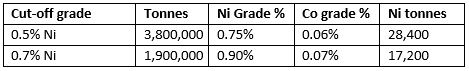

The Lake Yindarlgooda Inferred Mineral Resource Estimate is summarised in table 1. This estimate is compliant with JORC (2012) guidelines.

At a cut-off grade of 0.5% Nickel there are 3.8 million tons at an average grade of 0.7% Ni for a total of 28,400 tons of Nickel metal.

Table 1: Lake Yindarlgooda Inferred Mineral Resource Estimate

The Resource

The Lake Yindarlgooda resource is surface lying and naturally lends itself to free-dig style extraction, opposed to conventional hard rock style drilling and open pit blasting. Metallurgical testing of the ore to date confirms that the ore is favourable for processing. Nickel prices noticeably have been rising year on year since 2016.

Close to infrastructure, services and support

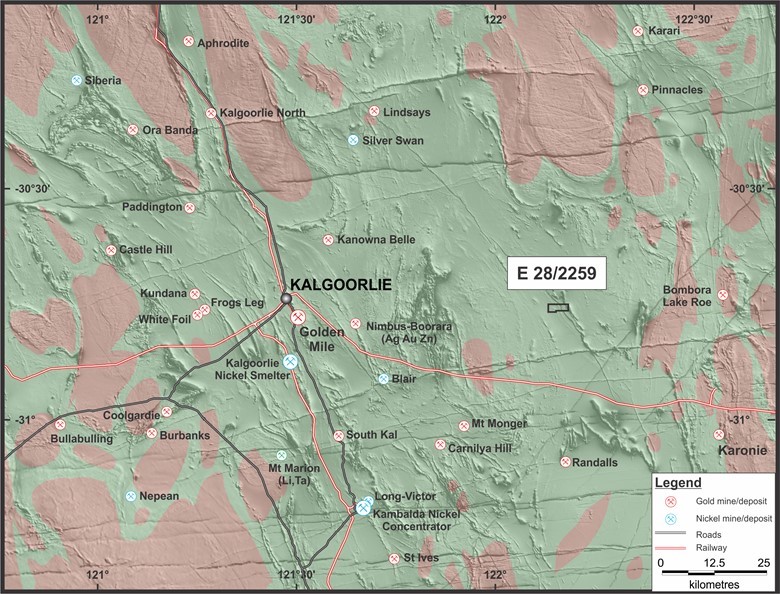

Ideally located just 60km east of Kalgoorlie (see image below) in the heart of one of the world’s most prolific belts of battery, precious and base metals, Lake Yindarlgooda encompasses eight square kilometres within the Hampton District of the Kalgoorlie-Boulder Shire.

Access to the tenement from Kalgoorlie is easy via the Mount Manger Road, which veers easterly onto the Trans Access road.

Lake Yindarlgooda (Exploration License 28/2259) is just 60km east of Kalgoorlie and proximate to many other highly successful nickel projects

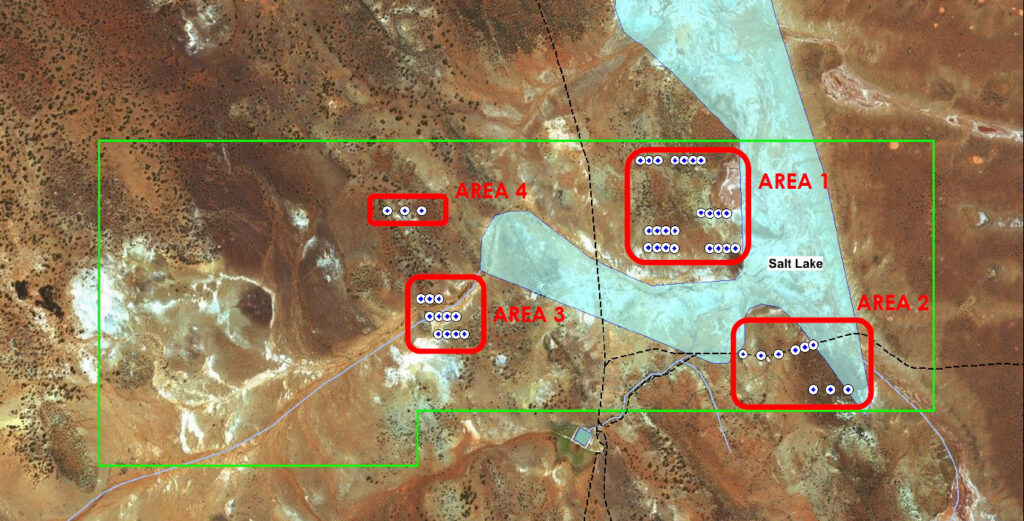

703 shallow auger holes were drilled at the project, providing a great foundation for the Joint Venture to delineate high priority as well as secondary targets over the project area.

The auger sampling was highly successful, defining strong Ni-Cu-Co anomalies along the eastern side of the project with adjoining Au-Cu targets to the west of this trend. Very strong VMS style (Volcanogenic Massive Sulphide) targets were defined in the west of the project, returning coincident Ag-Au-Cu-Zn anomalies. The sampling also defined weaker trends and zones of interest which warrant further in field investigation.

Following the completion of the auger drilling, the Joint Venture moved rapidly to undertake first pass stratigraphic RC (Reverse Circulation) drilling over the priority target zones (Areas 1, 2 and 3) as shown on the map below. A total of 21 RC holes for 1,626m were completed in holes varying from 48m to 126m in depth.

Area 1

Area 1 sits within the centre of the northeast quadrant of the tenement.

The area has significant nickel sulphide potential in a similar nature to neighbouring Poseidon Nickel (ASX: POS)’s rich Black Swan/Silver Swan nickel sulphide mine, which contains a high grade resource of 136kt @ 9.08% Ni for 12.4kt contained Ni at Silver Swan and a large lower grade resource of 29mt @ 0.59% Ni for 171kt contained Ni at Black Swan.

The area also has a prominent magnetic ultramafic sequence that displays elevated nickel geochemistry and points to a cobalt upgrade.

Also present are structured fault lines that are highly anomalous for gold, which, if found, the Company would intend to divest to a Joint Venture (JV) partner for development.

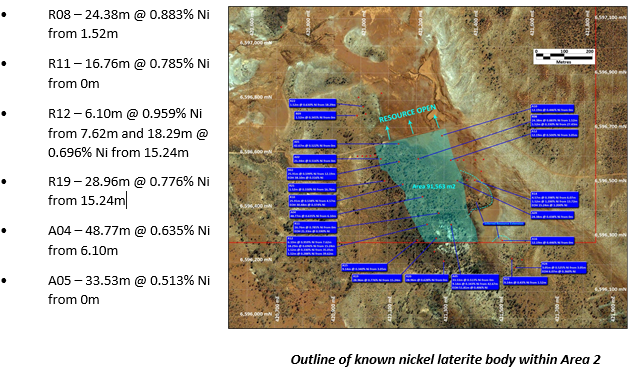

Area 2

Area 2 sits within the southeast corner of the tenement.

Within Area 2 there is strong evidence of Sandfire Resources (ASX: SFR)-style Volcanic Massive Sulphide (VMS) copper mineralisation.

The area is also highly prospective for nickel laterite and associated cobalt, exhibiting characteristics like the neighbouring Ravensthorpe and Murrin Murrin mines (owned by First Quantum Ltd (TSE: FM) and Glencore respectively).

As with Area 1, there is strong evidence of an ultramafic sequence beneath the laterite, which indicates a potential cobalt upgrade.

Historical drilling within Area 2 has already produced the following encouraging results:

Areas 3 & 4

Areas 3 and 4 occupy the western portion of the tenement, forming a potentially large-scale polymetallic venture with half a kilometre of strike zone.

This strike has strong VMS potential and comprises a body of volcano-sedimentary (water deposited) rocks that are highly anomalous for one of the most important battery metals, copper.

It is also anomalous for associated metals and minerals including zinc, silver and gold all of which would be divested to a JV partner for development.

Results have been received for the first 6 deeper holes which have returned extremely encouraging results, supporting the auger anomalies, the field observations and the VMS type of mineralisation being targeted within Area 3.

Of significance are holes LYRC001 and LYRC002 in the centre of the VMS target area which returned the following results which are associated with a fresh rock sulphidic black shale unit with interbedded felsic volcanics:

- 78g/t, 1.99g/t & 1.81g/t Silver (Ag)

- 46%, 0.18% & 0.12% Copper (Cu)

- 20%, 0.14% & 0.11% Zinc (Zn).